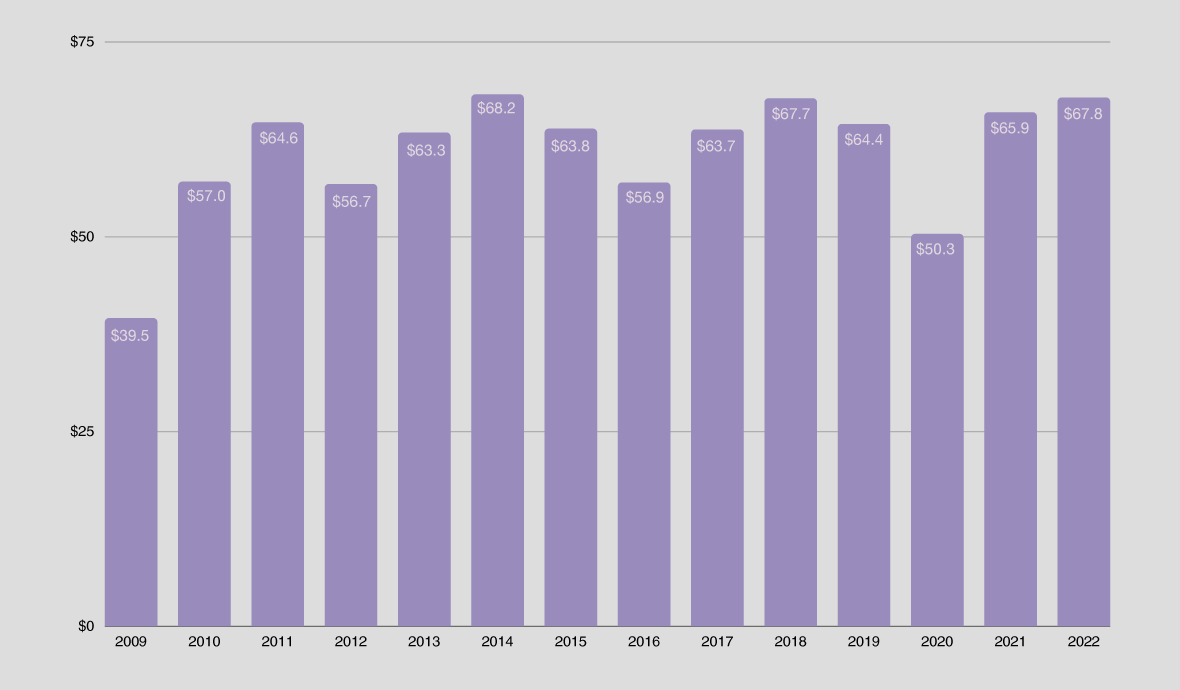

The Art Market in 2022: year closed with the second best result since 2009

Global art sales increased by 3% year-over-year to an estimated $67.8 billion, surpassing the pre-pandemic context in 2019. Transactions brokered by art dealers grew by 7% to $37.2 billion, while sales by auctions reduced slightly by 1%. As far as markets are concerned, the US retained the top position in the world ranking, accounting for 45% of transactions; followed by the UK, with 18%; China, with 17% and France, as the fourth largest art market worldwide, with 7%.

82% of the agents heard in the study are active in the sale of fine arts, with the primary market being the most expressive (45%), followed by those acting in parallel in the primary and secondary markets (42%), while a smaller portion (13%) is dedicated exclusively to the secondary market.

25% of the market agents show concern with sustainability and the carbon footprint of the art market, while 71% have political and economic volatility as their greatest concern.

The global market in 2022: year closed with the second best result since 2009

Global art sales increased by 3% year-over-year to an estimated $67.8 billion, surpassing the pre-pandemic context in 2019. Transactions brokered by art dealers grew by 7% to $37.2 billion, while sales by auctions reduced slightly by 1%. As far as markets are concerned, the US retained the top position in the world ranking, accounting for 45% of transactions; followed by the UK, with 18%; China, with 17% and France, as the fourth largest art market worldwide, with 7%. 82% of the agents heard in the study are active in the sale of fine arts, with the primary market being the most expressive (45%), followed by those acting in parallel in the primary and secondary markets (42%), while a smaller portion (13%) is dedicated exclusively to the secondary market. 25% of the market agents show concern with sustainability and the carbon footprint of the art market, while 71% have political and economic volatility as their greatest concern.

Global art sales increased by 3% year-over-year to an estimated $67.8 billion, surpassing the pre-pandemic context in 2019. Transactions brokered by art dealers grew by 7% to $37.2 billion, while sales by auctions reduced slightly by 1%. As far as markets are concerned, the US retained the top position in the world ranking, accounting for 45% of transactions; followed by the UK, with 18%; China, with 17% and France, as the fourth largest art market worldwide, with 7%. 82% of the agents heard in the study are active in the sale of fine arts, with the primary market being the most expressive (45%), followed by those acting in parallel in the primary and secondary markets (42%), while a smaller portion (13%) is dedicated exclusively to the secondary market. 25% of the market agents show concern with sustainability and the carbon footprint of the art market, while 71% have political and economic volatility as their greatest concern.

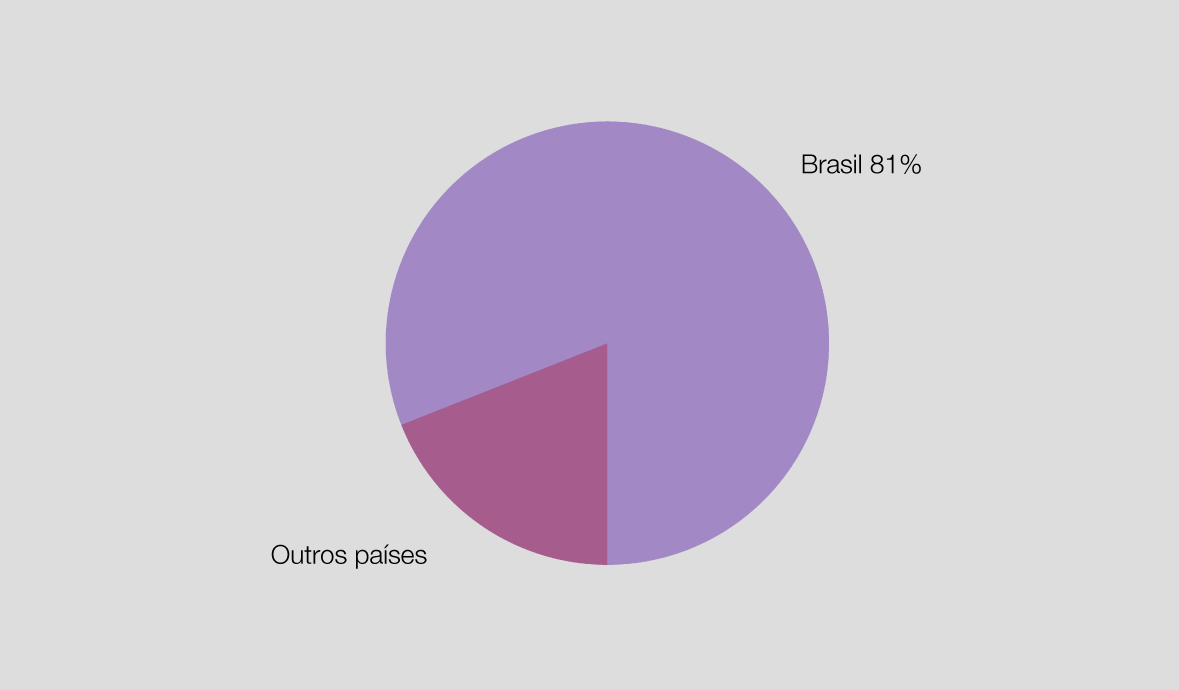

Sales in South America

Sales in Brazil represent 81% of the commercial movement of artworks in South America. Art Dealers based in South America reported the highest percentage of job expansion in the area (51%), in the US the growth was 33% and in the UK 25%. Among South American agents, 67% are hopeful for higher sales volume in the year 2023. Across Europe and the US, on the other hand, expectations were more moderate.

Sales in Brazil represent 81% of the commercial movement of artworks in South America. Art Dealers based in South America reported the highest percentage of job expansion in the area (51%), in the US the growth was 33% and in the UK 25%. Among South American agents, 67% are hopeful for higher sales volume in the year 2023. Across Europe and the US, on the other hand, expectations were more moderate.

Sales in South America

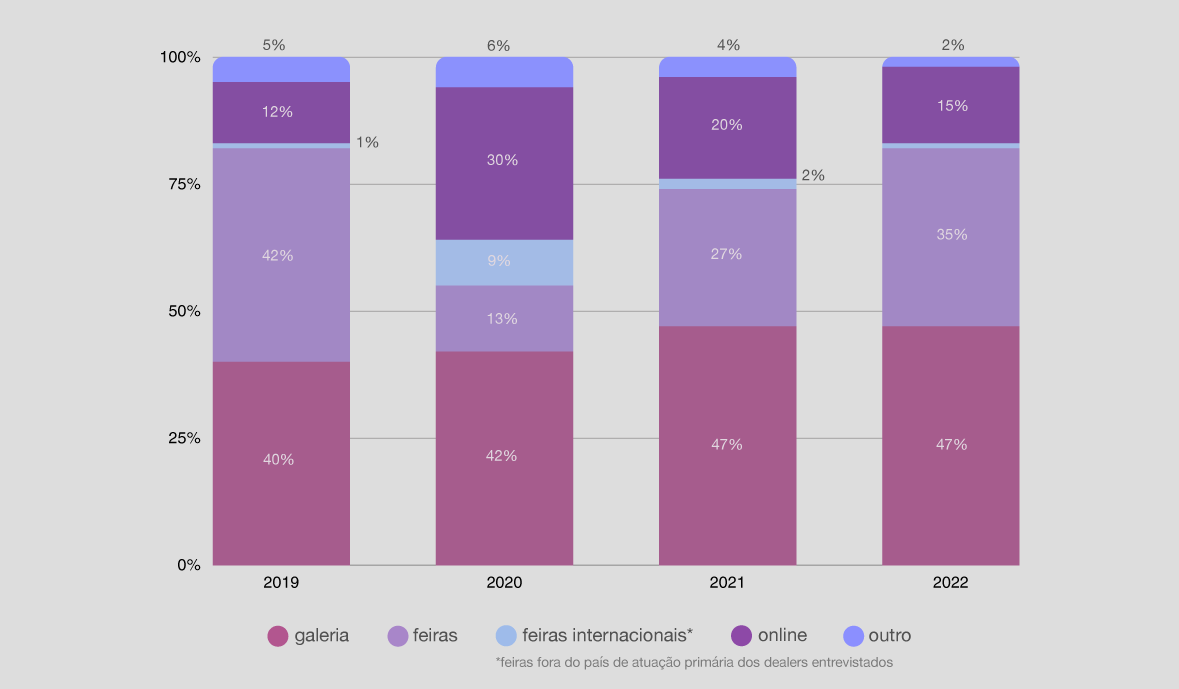

Sales in Brazil represent 81% of the commercial movement of artworks in South America. Art Dealers based in South America reported the highest percentage of job expansion in the area (51%), in the US the growth was 33% and in the UK 25%. Among South American agents, 67% are hopeful for higher sales volume in the year 2023. Across Europe and the US, on the other hand, expectations were more moderate. Market players and new buying habits Some galleries have been expanding their spaces, both locally and internationally. 71% of the art dealers surveyed operated from a single physical location - of these, 14% had expanded into a new region, while 9% had expanded into multiple regions. In addition, another insight is that while traditional mediums such as painting, sculpture, and paper still dominate sales and together account for 82% of transactions - video art has grown by 5%. Sales at art fairs also increased significantly in 2022, as galleries again exhibited at the same number of fairs, on average, as in 2019. Business transactions at in-person fairs increased by 35% in 2022, but remained below pre-pandemic levels in 2019, when they registered 42%. For 65% of those in the artwork trade, maintaining relationships with collectors is the top priority, followed by attending art fairs, with sales and exhibitions in third place. For the next five years, the priorities are expected to remain the same, along with the goal of expanding the geographical reach of the customer base. This is because new buyers represented, on average, 35% of the sales of art dealers worldwide. High net worth collectors remain optimistic about the market, spending more in 2022 than before the pandemic. Moreover, they look positively toward 2023, with strong spending plans - 77% expect the market to grow and most plan to expand their collection. However, macroeconomic volatility is still a point of discussion. Colecionadores de alto poder aquisitivo permanecem otimistas em relação ao mercado, gastando mais em 2022 do que antes da pandemia. Além disso, olham positivamente para 2023, com fortes planos de despesas - 77% espera que o mercado cresça e a maioria pretende expandir a coleção. No entanto, a volatilidade macroeconômica é ainda um ponto de discussão.

Sales in Brazil represent 81% of the commercial movement of artworks in South America. Art Dealers based in South America reported the highest percentage of job expansion in the area (51%), in the US the growth was 33% and in the UK 25%. Among South American agents, 67% are hopeful for higher sales volume in the year 2023. Across Europe and the US, on the other hand, expectations were more moderate. Market players and new buying habits Some galleries have been expanding their spaces, both locally and internationally. 71% of the art dealers surveyed operated from a single physical location - of these, 14% had expanded into a new region, while 9% had expanded into multiple regions. In addition, another insight is that while traditional mediums such as painting, sculpture, and paper still dominate sales and together account for 82% of transactions - video art has grown by 5%. Sales at art fairs also increased significantly in 2022, as galleries again exhibited at the same number of fairs, on average, as in 2019. Business transactions at in-person fairs increased by 35% in 2022, but remained below pre-pandemic levels in 2019, when they registered 42%. For 65% of those in the artwork trade, maintaining relationships with collectors is the top priority, followed by attending art fairs, with sales and exhibitions in third place. For the next five years, the priorities are expected to remain the same, along with the goal of expanding the geographical reach of the customer base. This is because new buyers represented, on average, 35% of the sales of art dealers worldwide. High net worth collectors remain optimistic about the market, spending more in 2022 than before the pandemic. Moreover, they look positively toward 2023, with strong spending plans - 77% expect the market to grow and most plan to expand their collection. However, macroeconomic volatility is still a point of discussion. Colecionadores de alto poder aquisitivo permanecem otimistas em relação ao mercado, gastando mais em 2022 do que antes da pandemia. Além disso, olham positivamente para 2023, com fortes planos de despesas - 77% espera que o mercado cresça e a maioria pretende expandir a coleção. No entanto, a volatilidade macroeconômica é ainda um ponto de discussão.

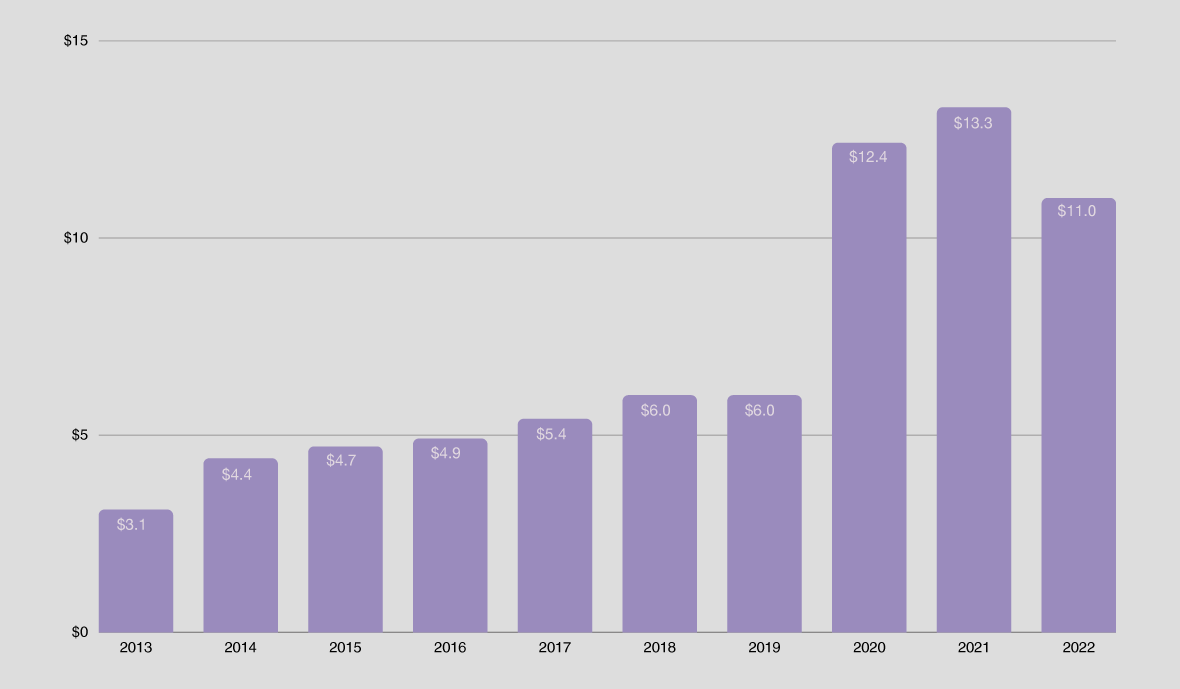

Sales in the digital environment

In 2022, online sales fell to $11 billion, a 17% decline from 2021's peak of $13.3 billion - but still, representing an expressive 85% increase in the comparative in 2019. In the last year, online sales accounted for 16% of the total value of global art market turnover - one hypothesis is that exhibitions, auctions and fairs have resumed their normalcy - indicating a collector profile that, on the whole, prefers to make a purchase in person. In addition, the NFT market registered a drop, closing last year at $1.5 billion, a 49% decline when compared to 2021 - which moved $2.9 billion. Despite the significant drop, sales were still about 70 times higher than compared to 2020. The report also revealed that the decline is particularly greater for art-related NFT than in other segments.

In 2022, online sales fell to $11 billion, a 17% decline from 2021's peak of $13.3 billion - but still, representing an expressive 85% increase in the comparative in 2019. In the last year, online sales accounted for 16% of the total value of global art market turnover - one hypothesis is that exhibitions, auctions and fairs have resumed their normalcy - indicating a collector profile that, on the whole, prefers to make a purchase in person. In addition, the NFT market registered a drop, closing last year at $1.5 billion, a 49% decline when compared to 2021 - which moved $2.9 billion. Despite the significant drop, sales were still about 70 times higher than compared to 2020. The report also revealed that the decline is particularly greater for art-related NFT than in other segments.

Auctions in 2022

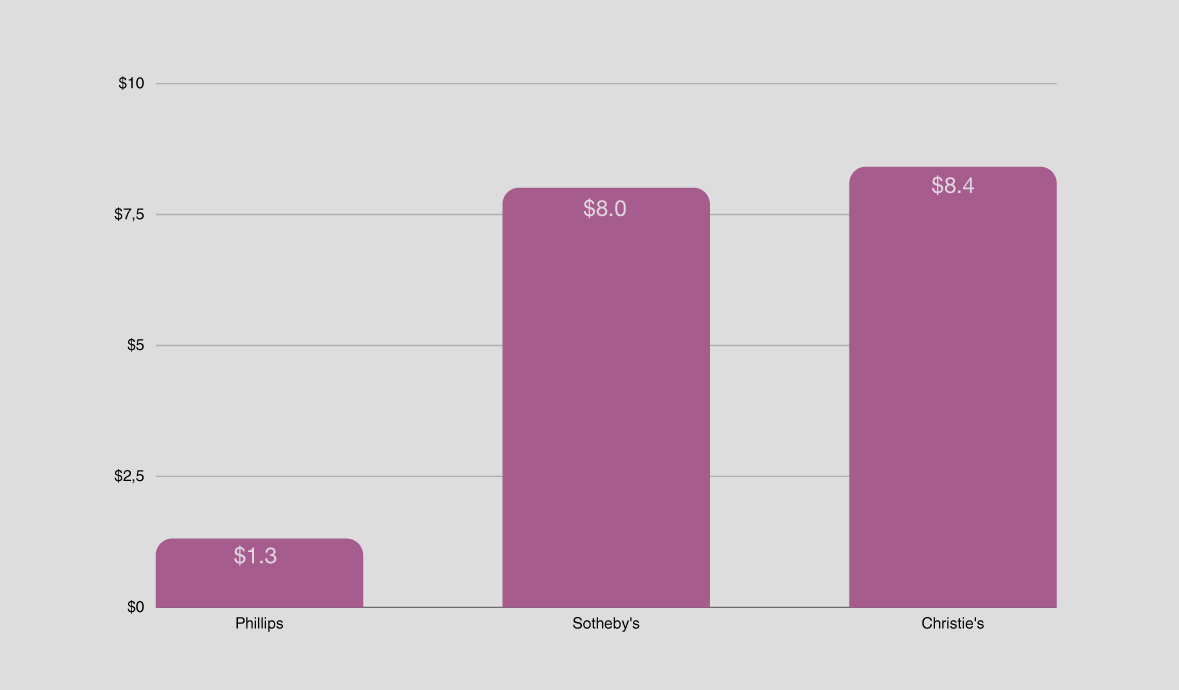

Despite many record sales in 2022, transactions at auctions registered a 1% decline, moving $26.8 billion in the year. The US, China and the UK remain the dominant auction markets, with a combined 76% increase in auction sales - most of the highest priced artworks were sold in New York, there were 41 of the top 50 lots. The world's leading auction houses reported significant increases in sales figures - among them Christie's, Sotheby's, and Phillips, which set a record in their revenues adding $17.7 billion. At all three houses, auction sales increased 11% in 2022, the second year of growth after a 70% rise in 2021. In the auction market, works sold at over $1 million accounted for 60% of sales, while works sold for over $10 million meant 32%. Impressionism and Post-Impressionism proved to be the most significant art movements at auctions held in 2022 - sales of these works increased by 25% and reached $2.6 billion.

Despite many record sales in 2022, transactions at auctions registered a 1% decline, moving $26.8 billion in the year. The US, China and the UK remain the dominant auction markets, with a combined 76% increase in auction sales - most of the highest priced artworks were sold in New York, there were 41 of the top 50 lots. The world's leading auction houses reported significant increases in sales figures - among them Christie's, Sotheby's, and Phillips, which set a record in their revenues adding $17.7 billion. At all three houses, auction sales increased 11% in 2022, the second year of growth after a 70% rise in 2021. In the auction market, works sold at over $1 million accounted for 60% of sales, while works sold for over $10 million meant 32%. Impressionism and Post-Impressionism proved to be the most significant art movements at auctions held in 2022 - sales of these works increased by 25% and reached $2.6 billion.

Compartilhar

Whatsapp |Telegram |Mail |Facebook |Twitter